- India

- International

Kiril Sokoloff: ‘The West’s time in the sun is over… this is India’s moment… it should take advantage of what both China and US can offer’

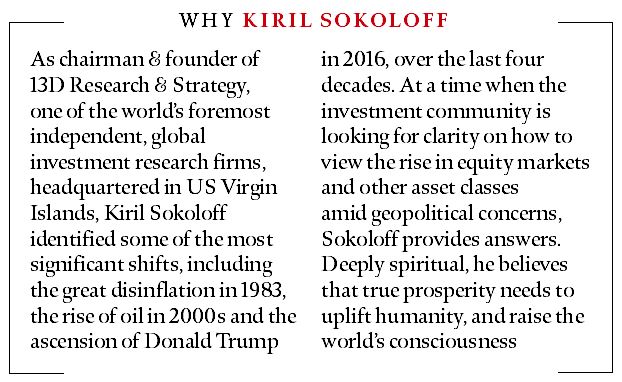

Kiril Sokoloff, Chairman & Founder, 13D Research & Strategy, on India’s strengths and its trade-off with China, the dangers of AI and why investing in gold is the future.

Kiril Sokoloff, Chairman & Founder, 13D Research & Strategy

Kiril Sokoloff, Chairman & Founder, 13D Research & StrategyKiril Sokoloff is a global investment strategist, thought leader and a visionary. He is the founder and CEO of 13D Research & Strategy, which is well regarded for discovering investment opportunities for its clients by applying a unique and open perspective and interpreting what the markets are telling. Kiril, who reads a lot of history, takes lessons from the past to see the future and has successfully predicted some of the big global shifts in the markets and economy over the last four decades including predicting the great disinflation in 1983, rise of oil in 2000s, ascension of Donald Trump in 2016 among others.

Kiril comes out with two weekly publications which are respected in the investment fraternity — “What I Learned This Week” and “What Are the Markets Telling Us?”

Sandeep Singh: There is lot of talk about Indian economy and markets with both people within the government and investment fraternity taking about India’s moment over next 10-20 years. How do you see it?

In 2017, we put out a recommendation that we thought the Indian stock market would be the best-performing market in the world over the next ten years. That is coming to pass. There’s probably more excitement and energy here than anywhere in the world. I was present at the opening up of China, and I saw how a civilisation that had been suppressed for hundreds of years and all of a sudden it opened up the floodgates gates and said “it’s all right to make money, go for it.” A similar thing is happening here in India. This is India’s time, India’s moment. Indian people own more gold than anybody in the world and I’m extremely bullish on the price of gold. While no one can predict how high the price will go, this means that every household in India could become rich. I can’t think of any country in the history of the world where one asset class, one change, is going to have an impact on almost everything.

(Right) Kiril Sokoloff, Chairman & Founder, 13D Research & Strategy, in conversation with Sandeep Singh, Editor (Mumbai). (Express photo by Ganesh Shirsekar)

(Right) Kiril Sokoloff, Chairman & Founder, 13D Research & Strategy, in conversation with Sandeep Singh, Editor (Mumbai). (Express photo by Ganesh Shirsekar)

Sandeep Singh: When you say it’s India’s moment, what comes on top of your mind to say that?

It’s obviously the excellent leadership. What Narendra Modi has done in terms of bringing the underground economy up and getting taxes collected and being able to build infrastructure, making lots of changes…The fact that fintech is the most widely adopted here in the world has huge significance. Hundreds of millions of people all of a sudden have access to bank accounts and money payments. If you go through history, there’s a time and a place for every country. It was ancient Rome, and then it was the Ottoman Empire, and then it was Spain and Portugal going to the New World, and then there was The Renaissance in Italy, and then various places in Europe, the UK, Germany, the United States, China. It is a cycle of history, and people just come alive with ambition, vitality and excitement, and this is what it is. It’s unstoppable.

“What Narendra Modi has done in terms of bringing the underground economy up, getting taxes collected and building infrastructure… People are alive with ambition, vitality and excitement. It’s unstoppable.”

P Vaidyanathan Iyer: I wanted to place India in the global context of uncertainty, at a time when there is a trade war between the US and China. The US actually wants TikTok to give up ownership in the US. There is the Russia-Ukraine war. There is a slowdown in China. So how do you place India in the global context and then look at trends thereof?

I think India has a unique opportunity to lead the world. The West has led for hundreds of years, and their time in the sun is over. It’s eroding in Europe. It was eroded with two World Wars, and America is consumed with disunity and dissension. Its foreign policy is struggling and India has an opportunity to come and to lead the Global South specifically. 88 per cent of the world’s population has not had access to the economic power that the 12 per cent had for the hundreds of years. I think India should be non-aligned and take advantage of what China can offer, what the US can offer. It is the fastest growing major economy in the world, and I think that’s going to continue. If the US is slowing down and capital flowing into the US diminishes, as I think it’s going to sometime next year or so, more capital will flow to India.

Why Kiril Sokoloff

Why Kiril Sokoloff

P Vaidyanathan Iyer: Norms, framework and regulation for AI are still being put in place across the world. In India, we haven’t really proposed a piece of policy on AI. Since many things need to fall in place for India to actually liberate AI, what are the two or three things that you think that India can take advantage of? One, with vis-a-vis AI, and second, what India should be cautious about while looking at a policy for AI?

AI has many dimensions. There’s a lot that’s good and there’s a lot that’s bad. I’ve spent a lot of time thinking about what the downside is. There’s going to be a huge amount of disinformation, which we’re already heavily burdened with. Elections would be threatened. We wrote as long as 10 years ago that three billion jobs would be lost around the world due to AI so there’s nothing new about AI causing job loss. It’s just that AI has reached the point where it is finally starting to come. Having seen this long in advance and having seen predictions like that not coming to pass, I’m somewhat sceptical. Obviously, jobs will be lost and it will improve productivity, but I haven’t seen anything conclusive. The risk of AI is that the power will be held by a few good companies, and those companies may not have India’s best interest or the world’s best interest. They’re after the power and the money, and I don’t know how that could be dealt with. That to me is the great concern. I was on an offsite with the founder of Microsoft’s AI, about six years ago. When the Internet was invented, I said the most exciting thing in the history of man was that all of human knowledge was available to all of humanity. But the reality was that a few companies got control over the information. So I said to him, “how could this have been predicted?” He said, “Well, Bill Gates predicted it in his book, and I wrote the chapter.” So we had a long discussion. How the most powerful companies in the world can be controlled from gaining tremendous power. India, of course, has a claim to the rightful fame of being the fastest country to adopt new technologies. I think that’s one of India’s great strengths and one of India’s great competitive advantages. That’s what India should try to do in this instance — to adopt AI faster and better in terms of usage than anybody else. We follow AI pretty closely. The Indian adoption rate is the highest in the world already. Indian people are using it more than anybody in the world, even much more than the United States. I think that that’s what the answer is. Obviously, for healthcare and diagnosis and solving problems, the upside of AI is it’s a problem-solver.

“There are three types of power: economic, military and moral… The West’s moral authority is eroding but India is the spiritual capital of the world… It needs to present itself this way, as bringing the world together.”

Anant Goenka: What could be a few downsides of AI for India?

As I said, a few dominant companies are going to control it and everybody else would be subservient and would be paying fees or will be behind. The guy who invented the whole idea of using data analysis in money management, James Simon of Renaissance Technologies, had probably the best record of anybody in the world. A breaker of codes during World War II and a great mathematician, was able to beat everybody with technology and the same thing could happen. So, whoever has access to that is going to have a huge advantage, will be better militarily, better at managing money, would bet better at understanding where the world is going and will have better solutions.

Express cartoon by EP Unny

Express cartoon by EP Unny

I was one of the biggest backers of cell phones. We went to Finland in 1997. We saw the future. And it was clear to us that there would be 3 billion smartphones in the next 10 years. Then when social media came, I thought it was going to have tremendous downside. I didn’t think it would be good for democracy nor for humanity. In the United States, it’s become such a horrible problem, mental illness of teens, that they’re really talking about banning cell phones for kids under the age of 16. It’s become that bad. Twenty-five percent of American children have seriously contemplated suicide. A vast majority of students in leading American institutions are having mental illness treatment. So something needs to be done. And the downside of social media has, in my opinion, vastly exceeded whatever upside there was — connecting people. So I worry about AI being the same. The downside — more information, more disinformation. What is true? What would be the fact checker? The child writes the paper, which is AI generated. How can it be determined that he didn’t do it himself? It just goes on and on. We’re living in a world where trust is abysmal and collapsing. This is just going to make it worse. The problem with the way we deal with technology is we’re just so excited about it. We don’t think about the downsides and don’t deal with the downsides. We don’t try to have a strategy for the secondary and tertiary impacts and we’re not thinking enough about unintended consequences. And we need to stop and say, what will this do? And The OpenAI board made an attempt and the commercial interests just overrode it. So I have no hope that there’s going to be any slowdown. It’s all about how fast can we go. Damn the consequences. I think we have to think about consequences, and it’s not all about growth, it’s not all about profits, it’s what we are doing to society.

Anant Goenka: Can concepts like environmental, social, and governance (ESG) make societal impact a part of commercial success?

I think so. What has been lacking is concern over climate change. It doesn’t mean that you don’t have the advances. It just means let’s all think about what the common interest is, not just what’s best for AI or best for the big tech companies, but what is the common interest? And the risk is, of course, if you allow this to go to extremes, and I’ve studied history, if you want to have a revolution, you allow things to go to extremes. If you wish there’d be a revolution, give me more social media. More kids commit suicide, and then you’ll have a backlash so big that it will undermine the whole process. By being somewhat moderate about dealing with the downside, or even thinking about the downside, you’re actually protecting the upside.

“The downside of social media has vastly exceeded its upside… We have to think about consequences… it’s not all about growth, it’s not about profits, it’s what we are doing to society.”

Anant Goenka: Is there a way to hold this in a commercial sense? Big tech is as large as countries right now. Is there a way to make a commercial pitch to them to be more responsible?

Eric Schmidt came down to visit Henry Kissinger, who was a close friend of mine, and he said, Henry, “Can you design ethics for our AI?” And Henry laughed at him and says, “This isn’t my problem, this is your problem.” They don’t know how to create ethics. They don’t have a moral responsibility. They’re not the people to do it. You look at Mark Zuckerberg before Congress, he gets slapped on his wrists and the next day he announces a buyback and dividend and the stock goes up $250 billion in value. It has to be a sense of moral accountability. That is the essence of democracy — if you want freedom, you must have responsibility. We want freedom, but we’re not willing to accept responsibility.

Kiril Sokoloff, Chairman & Founder, 13D Research & Strategy

Kiril Sokoloff, Chairman & Founder, 13D Research & Strategy

Anant Goenka: And whose job is it to instil it? Is it the government’s job? Is it the regulator’s job? Is it self-governance?

The private sector has never done a good job on self-governance. So what happens is it goes to an excess, then it’s a disaster, and people lose money and suffer in some way and then the government is forced to come in and regulate, and they won’t do it in a good way, had it been handled right at the beginning…So it has to be an enlightened government. It has to be a regulator who understands the technology, not to damage it, but to make it better.

Sandeep Singh: In that context, how do you see the emergence of strong leaders across the world?

Plato and Aristotle had this circle of how governments go, and democracy is a precursor to autocracy. Let’s look at the United States, we’ve got school shootings, we’ve got mass shootings, we have a fentanyl crisis, we have opioid crisis, we have depression in kids in school, and nothing is being done. People are saying, bring in someone to power who can get things done. That’s why Donald Trump is popular, because he has the wherewithal to do something. This is why Modi is popular, because he’s getting things done. This is why autocracy is on the rise. Look what President Xi did with TikTok, banning it, except for an hour a week. That’s anticipating the kids’ problems before they happen. So the societal structure in China is stronger than that in the US because a strong man made a decision. I wish it would happen in the United States. There’s some terrible things that are going on and nothing is being done.

Anant Goenka: You predicted a Trump victory in 2016. Are you predicting one again now?

I do think he’ll win.

Anil Sasi: Generally, gold is seen as a countercyclical hedge. But the rally this time around is despite the dollar staying strong and oil being stable. To what extent is this current rally triggered by global central banks buying more gold after the confiscation of Russia’s forex holdings?

Gold went down in the 80s and 90s, the deflationary period. Gold went up in the 2000s, an inflationary period. Gold went down in the first half of the 2010s, a deflationary period. It’s been rising since 2015 and clearly gold is signalling the resurgence of inflation. But it’s also signaling exactly the point you made– that central banks are selling treasuries and they’re buying gold because Russia’s foreign exchange reserves maybe confiscated and used in the war to fund the war. It’s confiscating a country’s assets and then putting it to redeploy it to fight against that country. It has to be one of the most cynical movements I can imagine. The Russians, of course, are going to confiscate an equal amount of American and EU assets held in Russia. So it’s tit for tat and nothing has been accomplished.

The US Congress has passed the legislation to do it. But the Europeans are sceptical about it because they know they’re going to take a big hit. Robert Schiller, the Nobel Prize economist, wrote recently that if America confiscates these foreign exchange reserves, it would be, ‘catastrophic for the US dollar’. I think the Americans don’t understand the significance of how the world sees this.

Kiril Sokoloff, Chairman & Founder, 13D Research & Strategy

Kiril Sokoloff, Chairman & Founder, 13D Research & Strategy

George Mathew: What’s going to be the fate of the US dollar? When do you expect the inflation to come down, and the interest rates also to come down?

So right now, the US federal interest (interest cost) is $1.1 trillion, without any interest rate cut. By the end of the year, it will be somewhere between $1.6 trillion and $1.8 trillion, meaning that the trajectory of interest costs for the federal government is going straight up, because a lot of the money is being rolled over at higher rates. This is creating a fiscal crisis. What we have is fiscal dominance. What will have to happen, I believe, is that to raise interest rates into an election year, it is very hard. I would be immensely surprised if they did.

…America was once in a very powerful position. It’s not of the same strength that it has been in the past, and therefore, were there to be a dollar crisis, it could be a very big crisis. I’m not necessarily predicting, rather what I’m saying is that the trends are in place. So, you have interest costs increasing and there was a story that recently said, when your interest bill is above your defence bill, the future of your civilization is doomed based on history.

Prof Zoe Imdad: Is the postponement of Elon Musk’s visit to India really to attend commitments or is something else you perhaps could highlight?

I’m sure he will (come to India). He’s very good at seeing trends. I think he has to be worried about Tesla in China because competition is very severe. And as he said, if the Chinese have free reign on EVs, they’ll wipe everyone out. So he’s probably looking to expand his business. He has some kind of an understanding with the Chinese, obviously. It’s possible the Chinese said, “no no, don’t establish a manufacturing base (in India).” I don’t know the reason. He can’t survive without China. It was amazing that he was able to pull off what he did in China. The technology of Tesla is the most advanced. I’m not an expert on this, but I think it’s more advanced in terms of technology than the Chinese companies. And of course, I’m sure there’s some kind of technology transfer taking place.

Soumyendra Barik: We’re seeing a renewed push here to establish India as a base for electronics manufacturing. The tension between the US and China has forced many American companies to look elsewhere. We hear China plus one strategy as far as the tech arms race is concerned but also a large chunk of important investments seem to be going to places like Vietnam and Malaysia. How does one look at this China plus one strategy context?

Well, decades ago, the US made a decision to financialise its economy, and China made a decision to make the things that people need. So China is the world’s best at this because it worked on this for many decades. Vietnam is clearly a Chinese FDI. It’s very hard to beat China on price and efficiency. I think the money will start to flow here when the economics start to make India a world leader in whatever area of manufacturing that it chooses to focus on. During my whole trip I was asking, what is the competitive advantage of India? The best answer I heard was that India swiftly adopts new technology. So that’s an area that should be hugely emphasised. Another advantage is that almost every Indian household holds gold, which means that they hold the one asset that’s going to go up in price and preserve value the best. So those are two huge assets. The Indian minds are fantastic. The programmers are very trained and very entrepreneurial. You look across the world and many CEOs of good companies are Indian. Where I think India has the opportunity is to be a leader. There are three types of power: economic power, military power, and moral authority. The West’s moral authority is eroding but India is the spiritual capital of the world. It needs to present itself this way as bringing the world together, focus on spirituality.

Anant Goenka: You said that the US has put on 12,000 sanctions. What percentage of them have been effective?

Zero! It’s been effective at destroying the economy in Venezuela and Cuba and hurting people but not changing political leadership. North Korea does its own thing. It hasn’t been effective in Russia. But there have been people who have been sanctioned that never should have been sanctioned. It’s an ivory tower mentality. The old story goes, you take the jug and you go to the well and you fill it up, but you go too many times and then the jug becomes cracked and then it breaks. That’s where it is. The world is sick of this American bullying and pushing and overreach.

Rajesh Kurup: In terms of investments, earlier you had placed your bet on oil in 2000s. Now what would you bet on, is it real estate?

One thing is very clear is that manufacturing is going to increase, but infrastructure is critical. When I came here in the early 2000s, the problem for me was infrastructure. I’d been involved in public-private infrastructure financing with Hong Kong when China opened up. It was called build-operate-transfer. And so we met with a lot of people here to discuss what was being done and what were the returns. It just seemed like nothing was being done. Now it’s all about infrastructure. So I would say infrastructure is huge. Retail has to be good. Banking, of course, is good.

Anchal Magazine:The post-COVID discourse on the Indian economy has had a lot of mention about income inequality, the sheer divergence in consumption patterns. So how do you see this divergence in the income and consumption pattern? Do you think in some way it could be a buildup of a bubble in India?

Well, one of the problems of prosperity is that money goes into property, foreign money comes in, domestic money goes in, and then housing prices get too high, and then there’s unaffordability. This is a chronic problem, and that’s why President Xi decided to break the property market because it was creating a vast wealth disparity. The very wealthy, you’d have to pay more. That’s fine. That’s no problem. In fact, you should tax them more, like they do in Singapore, over a certain price that you pay huge tax to the government. But the middle class needs to have affordable housing, so there has to be a lot of supply so that the prices don’t go up for them because otherwise you’re contradicting your goals. You want everybody to prosper, but if the cost of housing is going up more than your incomes are going up, you’ve made no progress.

Anchal Magazine: You mentioned taxing the rich more, in Singapore. Do you think there is space for that, given that we just have had a debate about the inheritance tax and wealth tax in India?

I’m not a fan of taxes, but the reality is that many governments are broke. I’m not necessarily talking about India, but just in general. Singapore is a benevolent dictatorship and a lot of Chinese and other money was coming in and the housing prices just went crazy, so they put a huge tax. It was 50 per cent or something massive on houses over a certain price level. If you’re very wealthy and you come in and it’s 50 per cent higher, it doesn’t bother you. But you (Singapore Government) can use that money to build affordable housing for other people. Generally, a tax on high earners, after a certain point of development, I would not say for India, but for the US, which is very developed and has extreme wealth, is going to come. I’m not necessarily in favour of it, but it’s an inevitable process.

Sachin Kumar: What’s your outlook on foreign capital flowing into India because the needle gap between India and the US has been shrinking. Do you see that shrinking is impacting the capital flows of India?

I’m a fan of permanent capital, not of hot portfolio money. So how can we attract permanent capital? I think that the capital concentration in the US has sucked capital from all over the world. If it were to end, and capital concentration always ends, the money is going to leave and one of the first places it is going to come is India. If in fact we are reaching the pinnacle of all that America can grab in terms of capital, then it can go the other way, which means capital dispersion. So it might happen to you this year. You might start to see more portfolio flows.

Anant Goenka: Last year, Larry Summers said, Japan’s a nursing home, China’s a jail and Europe’s a museum. Where do you take your money?

One may want to invest in hard assets– Gold. 20-40 per cent per cent should be in gold, silver, copper, uranium, and their shares. Then a certain amount of investment could be in new technologies — obviously AI, blockchain. I happen to like Bitcoin.

Anant Goenka: Do you envision a world where countries like India can actually purchase oil with gold rather than with USD?

Sure, gold has been around for 5,000 years and there’s settlement in gold. You could settle in Shanghai for physical gold. Gold could very easily come back to the monetary system. The Chinese have been buying gold for decades. It’s an old saying, but it’s true, whoever holds the gold makes the rules.

Ravi: What do you think should be India’s approach when it comes to trading with China?

India needs to maintain its sovereignty and India needs to be looking out for its own interests. China has a lot of things that India needs and India has things that China needs. What is the common interest? So whatever India decides to do with China should be made, decisions should be made with no reference to what the US wants. It should be based on what is best for India.

George Mathew: Most global stock markets are now at an all-time peak levels. What is driving these markets?

There’s an equity cult. The whole US fabric is built on higher stock prices, because capital gains taxes helps fund the US government. You take away capital gains taxes, and the deficit is really significant. So, the governments want equities to go up… I’m more concerned about the US and the capital concentration… It’s outperformed the world for 13 years with the highest percentage of the MSCI that any country has ever had. And the Magnificent Seven, an incredible increase in values. That is what I would be worried about.

Anant Goenka: You’re bullish on China because you said that China is really cheap right now.

I’ve never seen an asset class that is more hated than China since bonds in the 80s. And so I immediately like something that is disliked to this intensity. The foreigners have left. Everybody says the same thing. The same arguments they’ve been using for years. China’s growth last year was a lot in green energy. Last year China installed more solar and other green energy forms than the rest of the world put together. China can produce an electric vehicle for a fifth of what the US can. China can build a nuclear power plant at one-fifth of what the US can and nuclear power at one-third the amount of time. So, who’s going to win the nuclear construction contest?

Sandeep Singh: How would you classify India versus China for an investor?

India’s stock market has been going up a lot, it’s not particularly cheap. China’s stock market has been going down for three, four years. Last year, the Hang Seng was down for four years in a row, which has never happened before. So you’ve got a great buying opportunity right now. India is a long-term investment. You come here, you invest, you own for 10 or 15 years. So the two target different assets. I don’t think it’s either or, I think, as much India has it’s merits for global portfolios. You need diversification, and you can certainly do both.

Anant Goenka: Would you continue betting on big tech in America? Because the dominant companies are the guys who are taking AI forward.

Capital has hidden there because of the cash flows and the market dominance. And this is standard when you’ve had a big bull run, that capital concentrates in a few companies. We saw this in 1973-74. And then many of them never came back. I’m just not somebody who wants to participate in a game that has been going on this long. I’m looking for the next big thing, not yesterday’s.

Rapid Fire

The one thing you expect that will change in the world after the second Trump presidency.

Protectionism

There will be more or less protectionism?

More protectionism.

The one mistake Elon Musk has made.

Try to do too much.

The one thing Musk got right.

Incredible tenacity, determination, and never giving up.

The one Indian stock, you missed investing.

Infosys in 1997, when I met the founder.

The one asset class you recommend everyone must have in their portfolio which they probably didn’t have over the past 10 years.

Gold and gold mining shares.

In one line, the future of oil

Higher. The price will go up.

Why?

Sensing an increase in renewable energy, producers are aggressively cutting down on exploration.

You’ve mentioned your position on commodities across the board. For a 25 year old, that’s the median age in India, what percentage of that equity exposure do you recommend should be in commodities?

50 per cent

And which commodities?

Gold, silver, copper, uranium, oil.

The one mistake Biden has made.

Foreign policy

What percentage of a foreign portfolio do you recommend an American should put into India?

20 per cent

And in China?

20 per cent

May 19: Latest News

- 01

- 02

- 03

- 04

- 05