Top States to Consider Retirement in 2024: Insights on Affordable Living and Easy Reverse Mortgages

Equity Access Group highlights best retirement & reverse mortgage states, including Iowa, Pennsylvania, and Texas so that you can plan for a smooth retirement.

LADERA RANCH, CA, UNITED STATES, September 12, 2024 /EINPresswire.com/ -- As retirement approaches, many Americans are focused on ensuring their golden years are both financially secure and enjoyable. To help those nearing retirement make well-informed decisions, Equity Access Group has analyzed key factors that affect retirement living with the help of data from NASDAQ, U.S. News & World Report, and FBI-UCR. Our research evaluates key factors for an easy retirement: Cost of living, safety, healthcare quality, and the ease of obtaining a reverse mortgage.

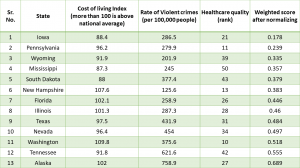

Top States for Retirement:

Our analysis focused on three important factors to find the best states for retirement: Cost of Living (40% weight), Crime Rates (30% weight), and Healthcare Quality (30% weight). We gave more weight to the cost of living (40%) because it affects daily expenses. Crime rates and healthcare quality were each given 30% because they are essential for safety and well-being.

By combining these factors, we identified the 13 states that don't tax retirement income and provide the best mix of affordability, safety, and quality healthcare. Here are the top states based on our findings (lower scores indicate better overall rankings based on the given criteria):

1. Iowa (0.178): Offers a low cost of living and a safe environment, making it ideal for retirees.

2. Pennsylvania (0.239): Known for its affordability and high-quality healthcare services.

3. Wyoming (0.335): Combines reasonable living costs with a safe environment.

4. Mississippi (0.357): Features a very low cost of living, though healthcare services could be improved.

5. South Dakota (0.379): Offers affordable living with moderate crime rates.

6. New Hampshire (0.383): Excellent healthcare and safety, though the cost of living is higher.

7. Florida (0.446): Benefits from a warm climate and relatively low living costs, despite higher crime rates.

8. Illinois (0.460): Affordable living and good healthcare services.

9. Texas (0.484): Provides diverse living options and overall affordability.

10. Nevada (0.497): Low cost of living and ample amenities.

11. Washington (0.518): High-quality healthcare and safety, though living costs are higher.

12. Tennessee (0.555): Affordable living, but higher crime rates.

13. Alaska (0.689): Unique benefits and great healthcare, although living costs are higher.

Top states for ease of getting a Reverse Mortgage:

Navigating the reverse mortgage process can vary significantly from state to state. Here’s a breakdown of some states where securing a reverse mortgage is generally more straightforward, making it easier for you to manage your retirement finances:

• Texas: Texas has clear and comprehensive requirements for reverse mortgages, thanks to a detailed constitutional amendment from 1997. This amendment outlines all necessary conditions and protections for borrowers, providing clarity and ease throughout the process.

• California: In California, while the reverse mortgage process adheres to federal guidelines, it offers some added benefits for borrowers. Notably, if you’re absent from your home for up to a year, as long as you maintain the property to your lender’s satisfaction, your mortgage won’t automatically become due. This flexibility can be quite advantageous.

• Arizona: Arizona's regulations, detailed in Title 6 of the Banks and Financial Institutions chapter, include clear rules and requirements for reverse mortgages. This includes provisions for financial counseling, disclosures, and repayment conditions, all designed to make the process more transparent and manageable.

• Florida: Florida generally aligns with federal guidelines for reverse mortgages, which simplifies the process. The state's adherence to these federal rules helps streamline the application and approval process.

• Colorado: Colorado’s statutes are designed to simplify the reverse mortgage process. The rules relieve both lenders and borrowers from overly burdensome statutory requirements, making the experience more accessible.

• South Dakota: South Dakota is known for its clear and accessible reverse mortgage laws. The state’s regulations define the rules for reverse mortgage loans, including how payments are made and handling undisbursed funds, making it straightforward for borrowers.

• Tennessee: In Tennessee, the reverse mortgage process is relatively simplified. The state’s codes provide a clear framework for lenders and borrowers, including detailed requirements for fees, interest payments, and loan balance calculations.

• New York: While New York has a structured approach to reverse mortgages, it can be more complex due to comprehensive regulations covering various aspects of the loan. However, this structured approach ensures a thorough understanding of your obligations and protections.

• Maryland: Maryland requires adherence to both federal law and additional state-specific requirements. Although this adds some complexity, the state’s rules offer a clear framework for reverse mortgages, including counseling requirements and detailed regulations.

The common states in both sections are Florida, South Dakota, Tennessee, and Texas. You can consider these states based on your personal preferences and situation.

Tip: When considering a reverse mortgage, it's important to be a primary resident of the home and plan ahead by buying a property in the state where you plan to retire. This ensures a smoother process and helps you make the most of your retirement.

Conclusion:

Selecting the right state for retirement can make a big difference in how enjoyable and stress-free your golden years will be. By considering factors like untaxable retirement income, cost of living, safety, and healthcare quality, you can find a place that fits your needs and lifestyle. Additionally, if you’re thinking about a reverse mortgage to help with your finances, some states make the process easier than others. Remember, planning ahead and choosing a state where you plan to spend your retirement will ensure a smoother transition and help you make the most of your retirement years.

About Equity Access Group:

Equity Access Group specializes in providing financial solutions tailored to the needs of retirees. Our mission is to help seniors achieve financial stability and peace of mind through products like reverse mortgages. EAG offers personalized consultations to help you understand the benefits and determine if a reverse mortgage is the right fit for your retirement plan.

Jason Nichols

Equity Access Group

+1 888-391-4324

info@equityaccessgroup.com

Visit us on social media:

Facebook

YouTube

REVERSE MORTGAGES — an expert Mortgage Lender's BEST-KEPT SECRETS

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release