Jefferson County Homeowners Might Be Overcharged As Homes Are Overvalued By 35% in 2025

O'Connor discusses how Jefferson County over valued homes by 35% in 2025.

BEAUMONT, TX, UNITED STATES, May 20, 2025 /EINPresswire.com/ --

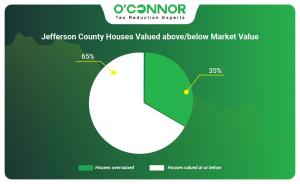

Jefferson Central Appraisal District has released proposed noticed values for property tax assessments in 2025. During the 2025 property tax reassessment in Jefferson County, 35% of homes were overvalued and 65% of homes were assessed at or below market value. Despite a large percentage of homes being below market, 35% of homeowners are still being greatly affected by market values. The average assessment value for residential in 2025 is 2.8% and commercial is 1.2%. These changes in value reflect adjustments for both existing and new properties, square footage, and price range.

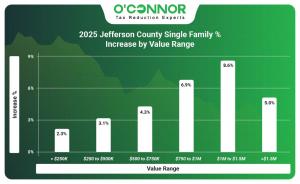

Home Tax Assessments Rise 2.8% in Jefferson County — Are You Paying Too Much?

An analysis of property tax assessments by value range in Jefferson County initially showed a positive trend, with assessed values rising in line with increasing property values, until the trend broke for homes valued over $1.5 million. The value assessment for homes valued at $250k or less increased by a mere 2.3%, which was the lowest value increase. The highest value increase was shown in houses valued between $1 million to $1.5 million with 8.6%. Surprisingly, houses valued over $1.5 million only increased by 5.0%, lower than the two other value range categories.

In Jefferson County, property values per square foot tended to rise with home size, with the largest homes seeing the most substantial increases. Homes that measured less than 2,000 square feet and those that measured between 2,000 to 3,999 square feet had similar value increases of 2.6% and 2.9% respectively. Houses that measured between 6,000 to 7,999 had the highest rise of value by 5.6%, growing from $141.8 million to $149.7 million. Another noteworthy increase was seen in houses that measured over 8,000 square feet with 4.9%.

According to Jefferson CAD, several homes according to year built had a mixed correlation in assessment values for 2025. The lowest increase was seen in homes built between 2001 to 2020 with 0.5%. However, homes built in 2021 and above saw one of the highest increases in assessments with 21.9%. Homes with an unknown or unassigned date experienced the highest increase of 22.5%, rising from $25 million to $31 million.

Property Values Inflated by 35% in 2025

In 2025, a striking 35% of homes in Jefferson County were overvalued by the Central Appraisal District when compared to actual 2024 home sales. While it’s encouraging that 65% of properties were assessed below market value – an improvement over previous years – thousands of homeowners are still being hit with unfairly high property tax bills. These inflated assessments can place an unnecessary financial burden on families, making it clear that there’s still work to be done to ensure accurate, equitable valuations for all.

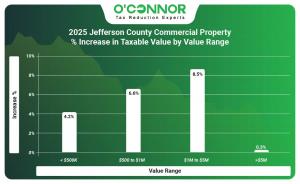

Jefferson County Commercial Assessments Averaged 1.2% Increase

An analysis of commercial property tax assessments in Jefferson County shows high increases for each property value range except for one category. The highest assessment increase was shown in commercial property valued between $1 million to $5 million with 8.5%. Surprisingly, the lowest assessment increase was seen in commercial property valued over $5 million with only 0.3%. The market value from 2024 to 2025 grew from $20.5 billion to $20.8 billion.

For the 2025 tax year, Jefferson CAD raised market values across all categories of commercial properties, but one category in particular had a minimal increase. The largest increases were seen in retail with 10.0%, growing from $583 million to $641 million. Noteworthy increases were also seen in warehouses property with 7.0% and a 2025 notice market value of $259 million. Land was the only category to experience a low increase of 0.3%.

Jefferson CAD’s 2025 commercial property assessments rose across all construction years, with certain categories experiencing more significant increases than others. Properties built in 2021 or later experienced the largest value increase with 23.6%, rising from $160.7 million to $198.6 million. Commercial property built before 1960 also increased greatly by 22.5%. The lowest growth in value assessment was seen in properties built with unassigned date by 0.3%.

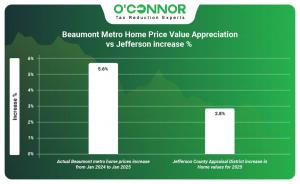

Jefferson CAD Appraised Values Out of Step with Market Performance

The 2025 commercial property tax reassessment by Jefferson CAD presents a gap to the report conducted by Wall Street firm Green Street Real Estate Advisors. While Green Street reports a 21% drop in commercial property values since their 2022 peak, Jefferson CAD shows a 1.2% increase in those same values over the past year – highlighting a clear disconnect between market trends and local assessments.

Jefferson County Apartments Overall Increased by 4.7%

The graph reveals an inconsistent relationship between an apartment’s construction year and the percentage increase in its 2025 property tax assessment in Jefferson County. Apartments with no assigned construction date experienced the highest increase at 84.2%, growing from $42 thousand to $77 thousand. In contrast, those built between 2001 to 2020 saw a decline of 1.2%, dropping from $712 million to $703 million.

Apartment owners in Jefferson County faced a 4.7% value increase overall in 2025. Regular apartment buildings increased by 8.6%, while multi-family apartment buildings declined by 2.3%. The market value from 2024 to 2025 grew slightly from $1.4 billion to $1.5 billion.

Older Office Building in Jefferson County Increased the Highest

According to Jefferson CAD, property tax assessments for office buildings in 2025 have increased across all construction years, particularly older properties. The smallest increase was seen in buildings built between 2001 to 2020 by 2.9%. The highest increase was seen in older office buildings constructed before 1960 by 19.9%, rising from $25 million to $30 million.

In 2025, property tax assessments for both medical and general office buildings in Jefferson County rose by an average of 5.0%. General office buildings saw the larger increase at 5.7%, while medical office buildings experienced a more moderate 3.9% rise.

Jefferson CAD Reports 10% Overall Assessment for Retail

Property value assessments for retail buildings in Jefferson County rose across the board, regardless of the year built. Retail properties constructed before 1960 saw a significant rise of 22.6%. The largest rise in value of 53.4% was seen in retail buildings constructed in 2021 or later, growing from $15.7 million to $24.1 million.

For Jefferson County, there are only two sub-types of retail property, as of 2025. Shopping centers saw the highest increase out of the two categories with 13.2% in value and a 2025 notice market value of $490.7 million. Single tenant retail property increased slightly by 0.7%.

Contemporary Warehouse Property Increased Greatly by 53.1%

Warehouse owners across Jefferson County faced property tax hikes in 2025, with the steepest increases hitting newer buildings. Properties built in 2021 or later saw a sharp 53.1% jump, while those constructed between 1981 and 2000 experienced a modest 2.2% rise. The market value in the past year rose from $242 million to $259 million.

Jefferson CAD reported the market values of warehouse property by sub-types, averaging 7.0% value increase overall. Mini-warehouse “average” property experienced the highest increase of 14.1% with a 2025 notice market value of $38 million. On the other hand, mini-warehouse “excellent” saw the lowest value increase of 4.5%. Mini warehouse “good” property was the only sub-type to experience a decline of 1.7%, dropping from $45 million to $44 million.

The Jefferson CAD increased by 2.8%, while the Beaumont Metro home prices have increased by 5.6% in the past year. The CAD’s valuation increases are trailing behind actual market appreciation. The graph illustrates that property tax assessments did increase, but not as sharply as real home prices.

Jefferson CAD 2025 Property Value Assessment Recap

Jefferson CAD’s proposed 2025 property tax assessments reveal a mixed landscape for homeowners and commercial property owners alike. While 65% of homes were assessed at or below market value, 35% were overvalued, indicating that more than a third of homeowners may face higher-than-warranted tax burdens. Average assessment increases came in at 2.8% for residential properties and 1.2% for commercial, reflecting broad adjustments across property types, sizes, and price ranges.

Appeal Your Property Values Each and Every Year

Texas property owners, including those in Jefferson County, have the legal right to challenge their property tax assessments. Whether the property is residential or commercial, the appeals process allows owners to submit evidence that supports a lower valuation. O’Connor works with a wide range of clients, from single-family homeowners to owners of large commercial, industrial, and multifamily portfolios. With nearly 50 years of experience and a proprietary database of market and appraisal data, O’Connor leverages proven, cost-effective strategies to help reduce property tax burdens. Appealing an assessment or partnering with a seasoned property tax consultant can be highly beneficial. In fact, most protests result in some level of tax reduction, making it a smart step for owners seeking relief from rising property valuations.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release